5 Simple Techniques For Clark Wealth Partners

Wiki Article

Clark Wealth Partners for Dummies

Table of ContentsThe Clark Wealth Partners StatementsThe Ultimate Guide To Clark Wealth PartnersThe Of Clark Wealth PartnersWhat Does Clark Wealth Partners Do?Top Guidelines Of Clark Wealth Partners

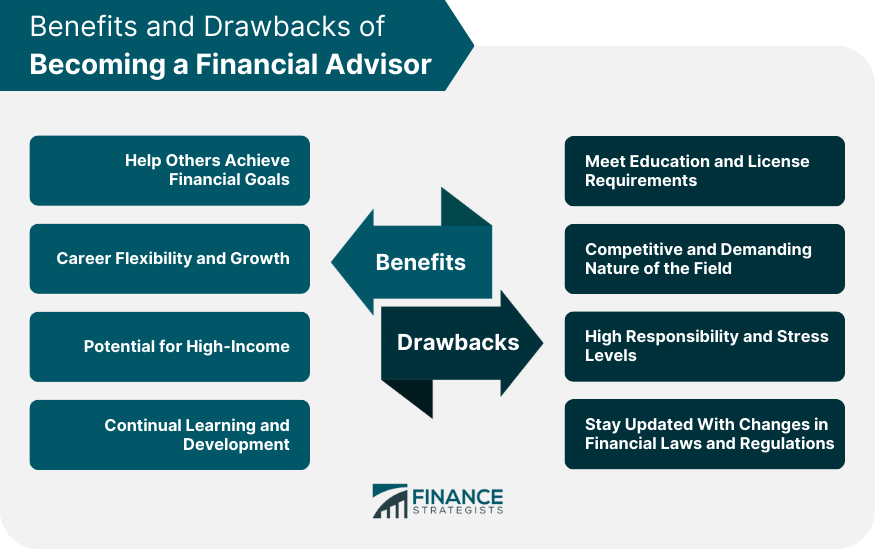

Basically, Financial Advisors can take on part of the obligation of rowing the boat that is your financial future. A Financial Expert need to collaborate with you, not for you. In doing so, they ought to serve as a Fiduciary by placing the best rate of interests of their clients above their own and acting in excellent faith while offering all pertinent realities and preventing conflicts of interest.Not all partnerships are effective ones. Prospective negatives of working with a Monetary Advisor include costs/fees, quality, and potential desertion.

Disadvantages: Top Quality Not all Financial Advisors are equal. Just as, not one expert is perfect for every potential client.

Clark Wealth Partners Things To Know Before You Buy

A client should constantly be able to address "what takes place if something occurs to my Financial Expert?". Always effectively vet any kind of Financial Advisor you are considering working with.when talking to advisors. If a certain location of proficiency is required, such as dealing with exec compensation strategies or establishing retirement for local business proprietors, locate advisors to meeting that have experience in those arenas. Once a partnership starts, stay bought the relationship. Dealing with an Economic Expert must be a collaboration - financial advisor st. louis.

It is this sort of initiative, both at the beginning and via the partnership, which will certainly assist highlight the advantages and ideally reduce the drawbacks. Do not hesitate to "swipe left" often times before you lastly "swipe right" and make a strong link. There will be a price. The duty of a Monetary Consultant is to help clients develop a strategy to satisfy the monetary goals.

It is important to comprehend all charges and the structure in which the expert operates. The Financial Advisor is liable for providing value for the costs. https://kitsu.app/users/1658298.

Clark Wealth Partners Can Be Fun For Anyone

You require it to recognize where you're going, exactly how you're obtaining there, and what to do if there are bumps in the road. A good economic advisor can put together a thorough plan to assist you run your service much more effectively and prepare for abnormalities that arise - https://1directory.org/details.php?id=348450.

Minimized Stress As a company owner, you have whole lots of things to fret around. An excellent economic advisor can bring you tranquility of mind knowing that your finances are getting the interest they require and your cash is being invested carefully.

Third-Party Point of view You are entirely purchased your business. Your days are full of choices and problems that affect your company. In some cases entrepreneur are so concentrated on the daily grind that they forget the huge image, which is to earn a profit. A financial advisor will check out the total state of your funds without obtaining feelings included.

Clark Wealth Partners Fundamentals Explained

There are lots of pros and cons to consider when employing a financial consultant. Firstly, they can provide useful competence, especially for intricate financial preparation. Advisors offer customized methods tailored to private objectives, potentially bring about better financial results. They can also minimize the stress of handling financial investments and economic decisions, supplying assurance.

The price of hiring an economic advisor can be significant, with costs that might influence general returns. Financial preparation can be overwhelming. We recommend speaking to a monetary expert. This totally free tool will certainly match you with vetted experts that serve your area. Here's just how it works:Respond to a couple of easy questions, so we can find a match.

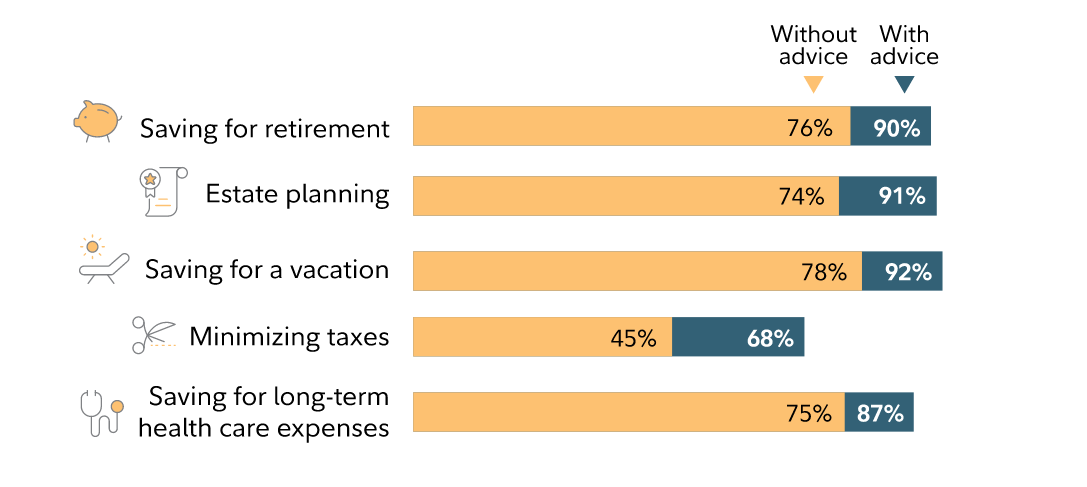

Find Your Expert Individuals turn to monetary consultants for a myriad of reasons. The potential advantages of employing a consultant include the expertise and expertise they use, the personalized advice they can give and the long-lasting discipline they can infuse.

Get This Report about Clark Wealth Partners

Advisors are experienced professionals who stay updated on market fads, financial investment approaches and economic guidelines. This knowledge allows them to offer understandings that could not be readily evident to the ordinary person - http://advertiserzz.com/directory/listingdisplay.aspx?lid=122536. Their knowledge can assist you navigate complicated monetary circumstances, make notified choices and potentially surpass what you would accomplish on your very ownReport this wiki page